Understanding Mortgage Amortization – Key To Reduce Your Mortgage Interest Cost

You should think about a fast debt consolidation auto loan calculators when you are worried about getting hounded by debt recovery agents which is the worst you can expect. Just imaging, going out to a party and suddenly your car is stopped by collection agents for recovery of old dues. Or you are sitting at home with family and friends, and unexpectedly there is a knock from unwelcome guests- the bank recovery guys. Have you realized why this situation arises in the first place? Had you kept your debts under control, you could have easily paid them off.

Many banks today offer housing loans or mortgage loans at their own interest rates. After you avail a loan, there is a fixed interest rate designated which will not change throughout the duration of the loan. Even if the interest rate changes, it will not change the rates of the loan you have undertaken. Monthly payments also called as EMI’s (Equated Monthly Installments) are needed to be made along with the interest rate. It is a fixed amount made by the borrower to the bank or financial institution every month. They are used to pay off both interest and the principal amount every month throughout the loan tenure. At the end of the payment schedule, you have to pay the unpaid amount in a lump sum. There are components that prove essential for calculating the EMI through a Home compound Interest rate calculator.

How does it help you with budgeting and future expenses? While your main goal with using a home loan affordability calculator is to pay off credit and mortgage loan calculators other debt, you also need to make sure that you have a way to budget your current and predicted future expenses. This includes both small items such as a new computer as well as larger items such as a masters degree or a house.

If you want more… but instead of being able to afford it, you go into more debt, well, that’s not very financially smart. You will need to STOP SPENDING and discipline yourself to create and stick to a spending plan.

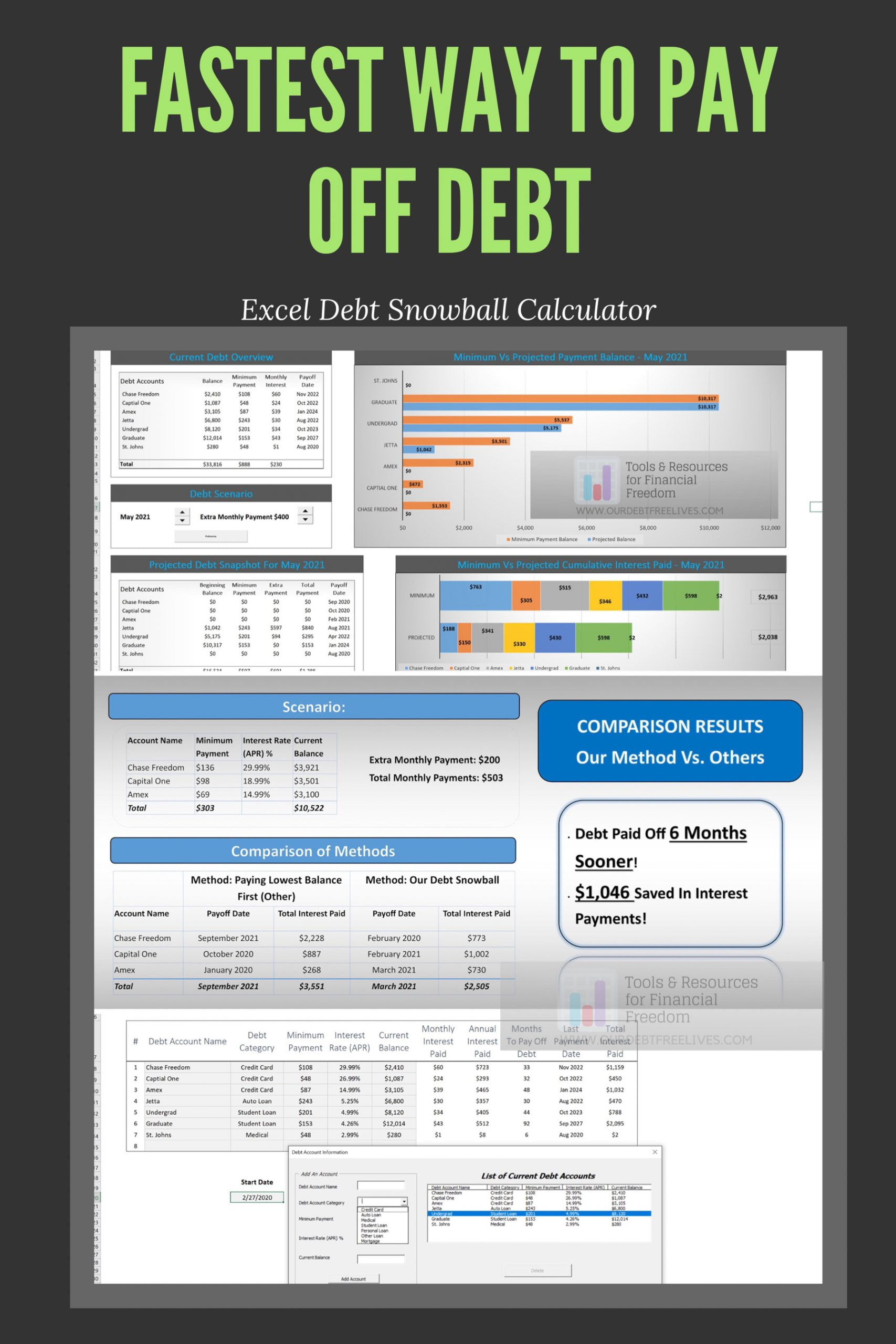

Once you have these figures entered into the program, you are likely to receive a graphical representation of your results. You should receive a chart or graph investment calculator outlining the amount that you could borrow at and and your estimated monthly payment. It may also include a sample of your amortization schedule, so that you can see how much of your monthly payment is going toward the principal at any given point during the loan. The graph may also show how much you could borrow if you the value of your home was more or less than your appraised value. This can be useful if you are using a ballpark figure or plan to make some improvements to the home in the near future.

Once finished, the car payment calculator will show you your estimated monthly payments. These are ballpark figures to let you know if you can afford the car and basically how much monthly you should pay for it.

Anybody who sells vehicles is aware of dozens of ways to extend their profit at your expense. Some of the major ones are to extend your interest rate, increase your down payment, make you pay any variety of hidden fees, or change the math used to calculate your payments. You won’t even notice you are being taken!

The secret is that our deep, emotionally driven need to spend money is actually the key to gaining control. Even better, we can harness these same emotional drives that have caused us to spend out of control to awaken our financial genius.

A mortgage calculator, that also includes debt to income ratio, can provide you with many details about your spending habits. This may be a great time to revise the spending you are doing and you may be shocked by the outcome. If you change your spending, you may qualify for a much better mortgage rate with better interest rates also.

If you have any questions pertaining to where and the best ways to use mortgage loan calculators, you could call us at our website.