Rv Financing For The Motor Home Of Your Dreams

Spending hours calculating the odds for the big races can give you a pain in the neck – literally. This happens when good prices are offered and when the horses have shown good form in the previous races. You haven’t noticed, but you’ve already given up your burgeoning social life. You are still trying your best to get the accurate numbers that’ll make you rich -fast. But your parents are starting to get really upset and your girlfriend is already fuming mad. You really should do something about it quickly.

Spending hours calculating the odds for the big races can give you a pain in the neck – literally. This happens when good prices are offered and when the horses have shown good form in the previous races. You haven’t noticed, but you’ve already given up your burgeoning social life. You are still trying your best to get the accurate numbers that’ll make you rich -fast. But your parents are starting to get really upset and your girlfriend is already fuming mad. You really should do something about it quickly.

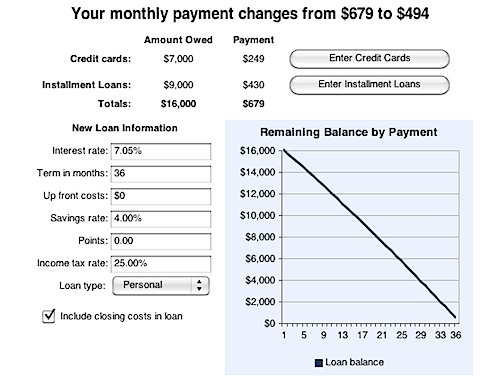

The first thing you would like to do is to calculate your debt. This will save you some time before applying for a consumer debt management option. Organize on a sheet of paper all your debts: the exact amount that you owe and to whom (credit cards or banks), how much you are paying monthly, how much is the interest of each debt. After this, go online and search for an online compound Interest rate calculator and enter all this information there. This will give you an idea about how much you owe and how long it will take to pay it.

Now, here is how your debt to income ratio is and whether it is too high or not to buy a home. To figure this, you want to take your total monthly expenses and divide it by your gross monthly income. For example, if your expenses are $2,000 a month and you make $3,500 a month, your ratio is 57%. This is just an example to show you how to figure your own ratio.

Tools like the car loan calculator make life easy for the loan seekers, a great deal. There is no need to be confused about the figures involved in the loan transaction any more. The rental property calculator, your wonder tool will present you with all the desired figures and will make the process smooth and hassle free. Be it installments, APR or whatever everything will be provided to you on a plate in this case. So stop worrying about whether you will end up paying more car loans interest and start thinking up which is going to be the color of your car.

Online mortgage calculators can help you see how getting a lower interest rate can have a big impact on your total repayment. If that same loan came with a 6 percent interest, then you would pay a total of 289,595.46. Just by getting a 1.5 percent interest reduction, you save almost 90,000 over 30 years. If you’re lucky enough to qualify for a 5 percent interest rate, then you will spend 146,154 less than if you had the 7.5 percent interest loan.

This time you saved $15,000.00! You saved almost double by spending the same amount of money! Also, if you happen to stay a bit longer than you anticipated than that principal is going to go down quick! The cheaper it is, the quicker is sells also, so when it comes time to actually sell it will turnover quicker. What a great way to save money!

Bills also contribute to a large debt and only make the burden heavier. Instead of setting aside money for debt investment calculator payments you also have to set aside money for the bills. If you can reduce your bills just a little bit, you can increase your savings.

The maximum amount that you may buy in one calender year is $5000. If you cash these bonds in before five years then there is a penalty of the last three months of interest. An example of this, if you purchase a bond and cash it in 36 month later then you will only get 33 month of interest plus the original investment. They can’t be cashed in before they are one year old except in certain circumstances.

Mortgage refinancing may or may not get you out of debt. It will all depend on you. If you are committed to stick to your budget and spend years paying off the loan, then you are a good candidate. Tread carefully when you are getting mortgage refinancing to pay off your debts. You never know what you’ll step on.

If you have any kind of concerns about exactly where in addition to the way to work with Modern Calculators, you’ll be able to e-mail us on the web-page.