You Can Get A New Car Loan With Credit Score

Managing your finances can be a tricky job. These days consumers have a number of demands on their incomes from essential bills through to credit product repayments. If you are considering taking out a loan for your new car then a car loan in uk loan calculator can be a valuable tool.

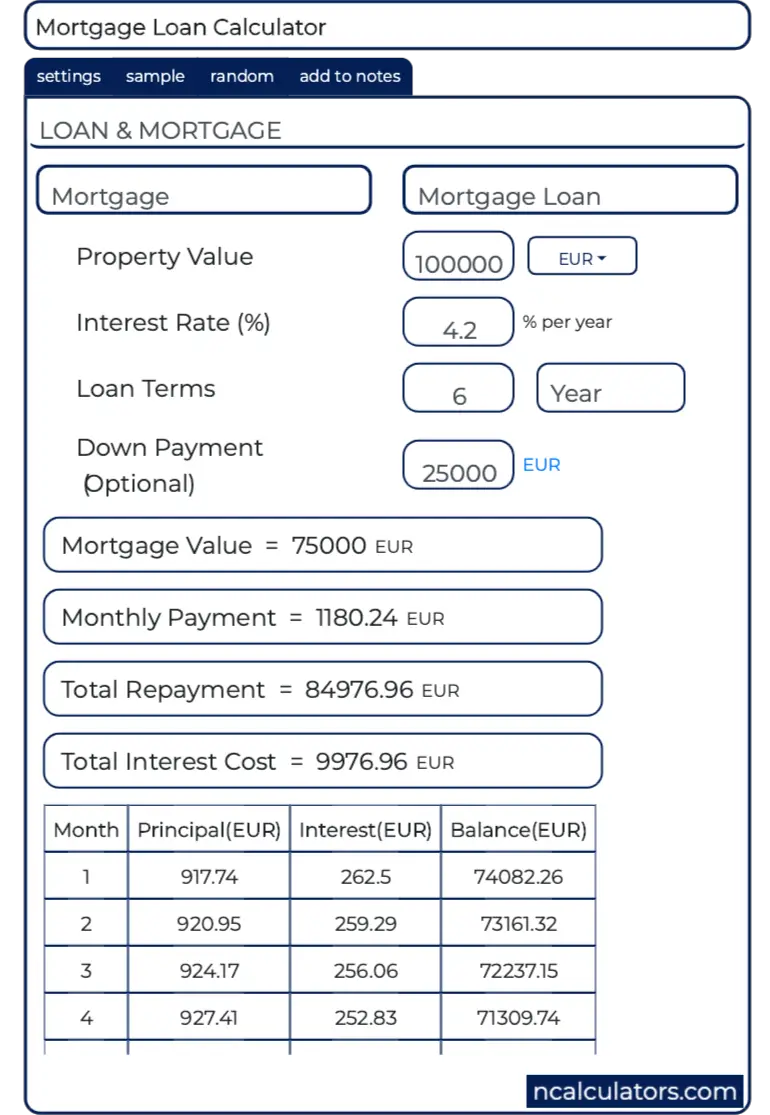

To use a depreciation calculator , you will need to input much of the information that you know about your potential loan. You will tell it how much money you are borrowing. You will tell it the interest rate that you have been quoted for the loan. (If you are not sure, get a few instant, online no obligation quotes so that you can compare them.) And, it will require that you enter the terms (or length) of repayment of the total cost of the loan. With that said, you will be able to get a good deal of information.

If you have credit card debt that cannot be paid off within three months, you have way to much debt. It just costs you too much. It really isn’t all about whether investment calculator or not you are making ends meet. It is about what the overall cost of the debt is to your finances. If you are paying interest, you are losing money that could be earning interest in a retirement or other savings account.

By doing these simple things, you can save yourself from running a huge debt. You also get to save more and pay your debts quickly. All it takes is a little know-how. You can also seek help through debt settlement if your debts are too big to handle, to help you eliminate credit card debt legally and for good.

And the Rule of 72: Divide the number 72 by the interest you earn, and it will give you the number of years it will take for your money to double. Using the above example, 72 divided by 6 equals 12 years for doubling. Pretty simple-hah! Since there are two doubling periods in 24 years, the original $10,000 would be worth $20,000 in 12 years, and $40,000 in 24 years.

Using tools to organize and calculate your financial problems right now can help you be free from debt. A debt reduction planner for example will help you to see how many days are left before you finally pay off your debt. It also allows you to organize your budget. Along with the annualized percentage rate calculator, you will be able to keep track of your payments and how much is still remaining before you eliminate debt for good.

Well, lenders have a reason for it. They know that you are crazy for your car and won’t let it repoed. But at the same time, it is becoming extremely difficult for you to make such high payments. They know that you just need a low-interest loan. Lenders are assured that they will not lose money if they decide to mortgage refinance you.