Auto Loans Rates – What To Think About For You Must An Auto Loan

Everybody thinks that 401k early retirement plan is a great idea. It can be tempting to go with the flow, and look at all the 401k early retirement calculator Online Loan Calculators magic and go ahead with it. And the 401k early retirement calculators might be right, and it might be a great idea. But first, you have to learn more about it.

Everybody thinks that 401k early retirement plan is a great idea. It can be tempting to go with the flow, and look at all the 401k early retirement calculator Online Loan Calculators magic and go ahead with it. And the 401k early retirement calculators might be right, and it might be a great idea. But first, you have to learn more about it.

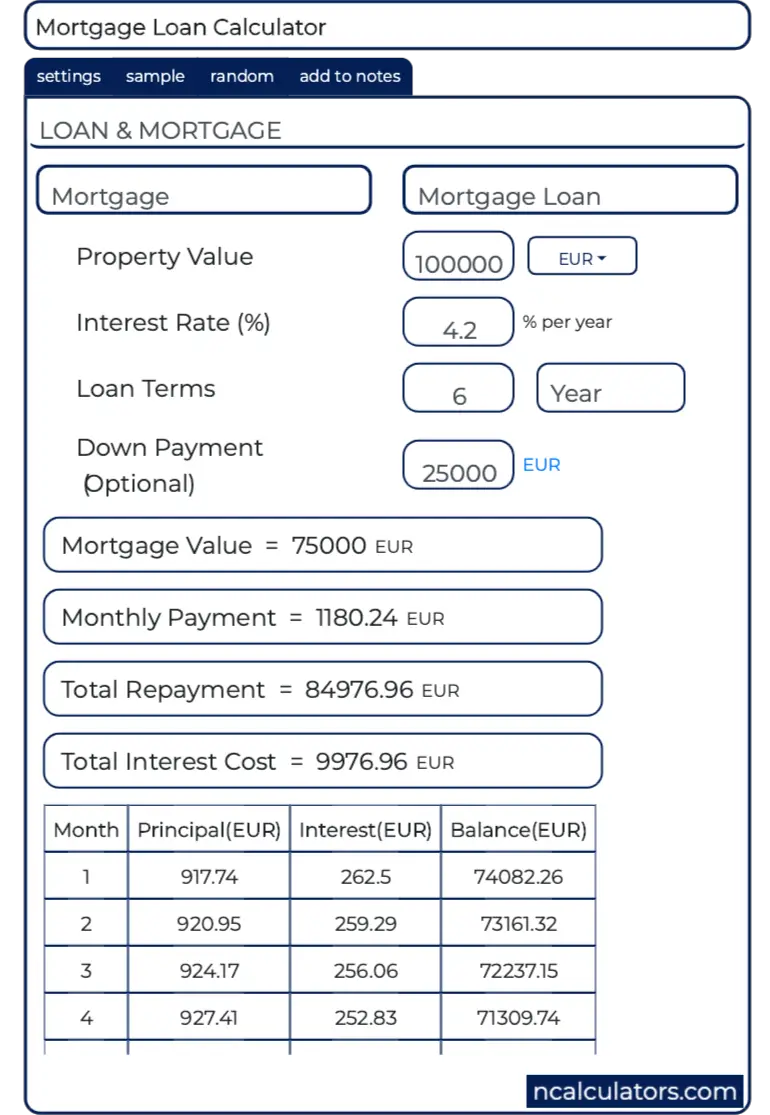

The real problems most people face with their debts are the fees and interest added to that principle. To get the grand total of your debt, you have to do your calculations taking these figures into account. Sounds like an awful lot of complicated math, doesn’t it? Don’t worry. You don’t have to try to access that long forgotten freshman math course. You can rely on a personal loan calculator to help you develop a full picture of the money you owe.

Always make sure you are fully aware of your own financial situation, your earnings, your expenditure and exactly whether you can afford to borrow money, before you go ahead and commit to any loan or type of credit.

There are a lot of factors that need to be verified before you opt for a particular loan. Verification of the interest rates whether they are fixed or not is very important because if they are not fixed then later the loan can cost you a lot more. If a vendor offers you car loans on astonishingly low prices then please make sure you use the auto discount calculators to find out the rebate that you will be forsaking in this case. If you are losing out on a substantial amount in the rebate then the low interest car loan is not worthwhile for you.

Let investment mortgage payment calculator me show you an example that demonstrates this difference. If you take a loan for a new car for $21,325.00 making 36 payments (3 years) and paying 5 percent interest you will pay $639.13 per month and pay $1,683.66 in interest. Using that same amount of $21,325.00 at 5 percent interest for 60 payments (5 years) you will pay $402.43 per month and pay $2,820.74 in interest. You end up paying $1,137.08 more in interest because of the longer term.

When a customer knows that for a specified sum, he has to pay a certain amount of interest, things become simple. This way, you get an idea of the possible outcomes that will help you analyze the different options. Based on the evaluation, you will be able to choose a deal that suits your wallet and lifestyle. Car loan calculators will help you know whether you can handle your monthly budget after paying out the interest for the car. In simple words, you will able to save money when you make the calculations right.

The difference between HYIP losers and HYIP winners is centered on the three keys of seed money, compound interest, and greed level. When you understand and master those three concepts, you will be numbered among the 10% of hyipers that win this game.

If you beloved this article and you would like to get more info regarding financial investment management please visit our own web-page.