Drive Home Your Dream With The Aid Of The Auto Car Loan

Credit card debt consolidation calculator is a very useful tool, if you wish to turn around that heap of bills and unpaid loans. The consumerist society that we live in, make us all easy targets for debt traps. Easy availability of plastic money makes things worse. Once you use the overdraft facility on your credit card, you will be charged high fees and interests, and more often than not, you will end up getting a new card to pay off the bills on your old one. This is how you land into the financial mess that is called a debt trap.

Credit card debt consolidation calculator is a very useful tool, if you wish to turn around that heap of bills and unpaid loans. The consumerist society that we live in, make us all easy targets for debt traps. Easy availability of plastic money makes things worse. Once you use the overdraft facility on your credit card, you will be charged high fees and interests, and more often than not, you will end up getting a new card to pay off the bills on your old one. This is how you land into the financial mess that is called a debt trap.

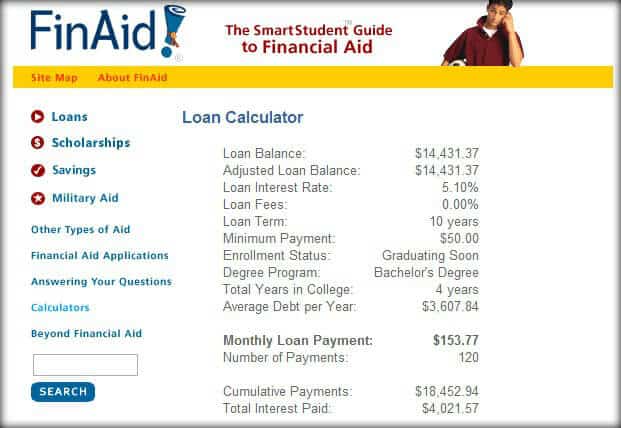

It is very easy to use a debt to income ratio calculator. You simply put in some numbers and you will be able to view results immediately. You may also have a choice of lenders that will show their rates and compete for your business. This can be a great way to do some comparison shopping all in one place.

So, calculate the APR (Annual Percentage Rate). It will express the exact interest rate for a whole year instead of monthly payments and will be an effective tool for comparison. Take help of the online business loan calculator to compute the exact benefit.

Create a get out of debt and a wealth creation roadmap. A good savings calculator tool will make this easy to do and give you a variety of ways to create reports.

While using this tool, you should remember that the answer of it still depends on you. If you’ve put a wrong number or information on it, of course the answer will also be wrong. Because of this, carefulness is really important. Or else, you’ll get answers that might just mess your decision.

What are the features of the investment calculator? You want to choose one that offers a wide variety of features. Some of the main things to look for include: credit card payoff dates based on varying payment amounts, suggestions on how to pay less interest, the ability to compute pay off dates for other loans such as student home equity loans company, car payments and personal loans, a comprehensive review of debt paid off as well as debt that still needs to be paid and other items that represent your overall financial plan.

The Rule of 72 works best with fixed investments, or those with a fairly stable return. Also, it only works if you reinvest your assets. The Rule does not apply if you withdraw any funds.

This is usually in the form of a consolidated loan, but not a federal government loan consolidation. Rather, the banks have formed private loan consolidation companies that can perform this service for you.

If more than three of the above statements are true for you, you need to take steps to get out from under your debt. It isn’t as hard as you might think it is. It just takes time, dedication and change. Don’t believe any company that says it can erase your debt or repair your credit quickly. These are scams that target those with debt problems. The only way out is to pay your debt off as quickly as possible. You will have to budget, cut back and federal government loan stop using your credit for a while. But it is worth it. Once you are started, you will find that it feels good to pay off your debts and regain control of your money.