Few Advice For Credit Card Debt Relief

Neighbor two’s situation, surprisingly, is a lot more common a scenario then one might think. CBC’s Metro morning ran a feature February 13 on the surprising number of people in the greater Toronto area who have full time jobs, but are still living in the poverty range.

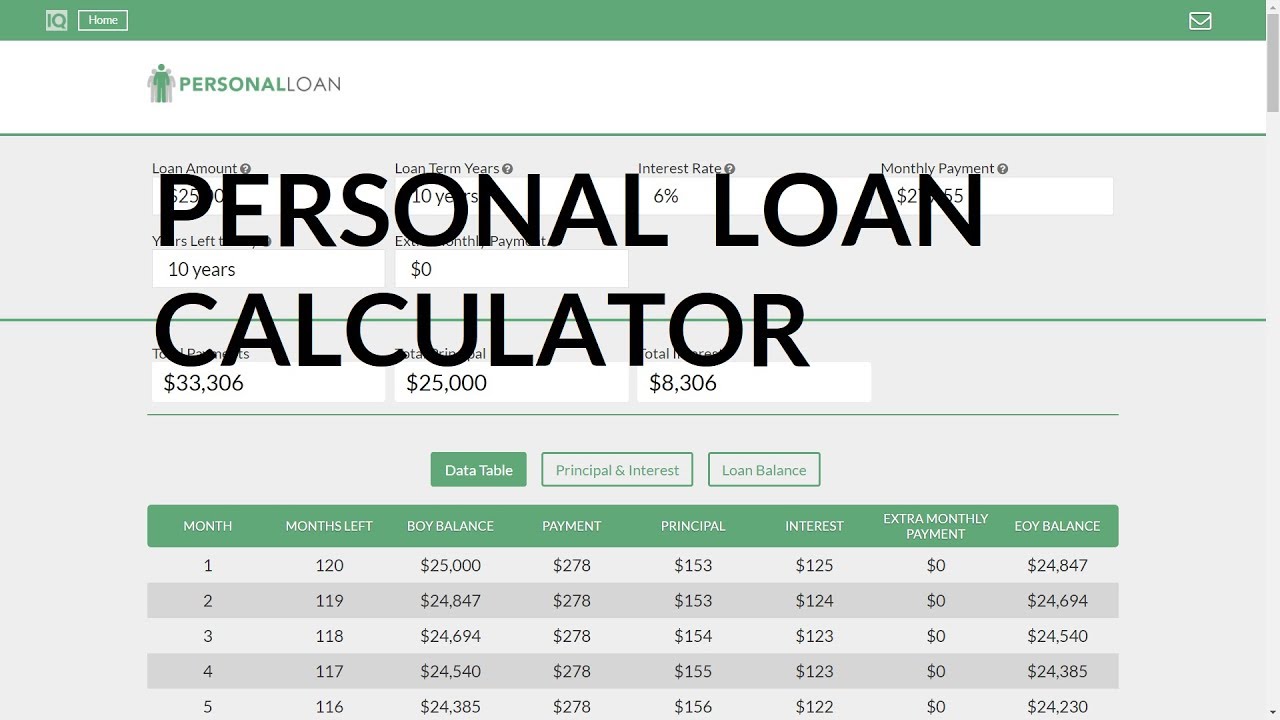

There are a lot of companies that designs applications. Most of the companies are focused on a specific segment of the market. Some application development companies focus on games, which has the biggest market share of all the applications. Some companies focus on the applications that will help you with your daily life. For example, calculators are very common applications that you come across. These calculators usually focus on a single purpose: Tip calculator, loan down payment calculator, mortgage calculator, body mass index calculator, unit converter. The list goes on. Who needs these calculators? In reality, there are always people who need these applications.

The credit card rental property calculator is a very interesting tool. You can enter the information in several different ways. You can enter the number of months that you want to make payments, along with the balance and the interest rate and it will return the amount of the payment you will have to make each month in order to accomplish your goal. This can be a very powerful tool when it comes to planning your debt management strategy.

Online mortgage investment calculator can help you see how getting a lower interest rate can have a big impact on your total repayment. If that same loan came with a 6 percent interest, then you would pay a total of 289,595.46. Just by getting a 1.5 percent interest reduction, you save almost 90,000 over 30 years. If you’re lucky enough to qualify for a 5 percent interest rate, then you will spend 146,154 less than if you had the 7.5 percent interest loan.

While using this tool, you should remember that the answer of it still depends on you. If you’ve put a wrong number or information on it, of course the answer will also be wrong. Because of this, carefulness is really important. Or else, you’ll get answers that might just mess your decision.

This current economy has really put investment decisions I’ve made in the past 8 years under the microscope. In a hot real estate market, investment decisions have a lot of leeway to succeed. The converse is also true in a bad economy and leads me to ask questions like: Did the properties I bought maintain value (relatively speaking) or did I misread the area? Do renters want to live in these homes when much more choice became available? Can I sell any of these investment homes in a flat or declining real estate market?

When a customer knows that for a specified sum, he has to pay a certain amount of interest, things become simple. This way, you get an idea of the possible outcomes that will help you analyze the different options. Based on the evaluation, you will be able to choose a deal that suits your wallet and lifestyle. Car loan calculators will help you know whether you can handle your monthly budget after paying out the interest for the car. In simple words, you will able to save money when you make the calculations right.

But you should always keep in mind that the monthly payments given by the used car loan calculator are just estimates. Remember that actual payment may vary depending on your loan terms. It does not take into consideration the cost of taxes, tags or other fees in the cost of the vehicle.

In the event you adored this short article and also you would like to get details regarding reduce credit card debt i implore you to pay a visit to the webpage.